When is the best time to renew home insurance?

Why timing your renewal right can cut costs (and auto-renewing rarely pays)

The date you renew your home insurance can affect how much you pay. Simply letting your policy auto-renew will likely result in you paying more than you need to, while renewing earlier – or even switching insurer – can cut the cost. This guide explains when to renew and what to consider if you’re deciding whether to stay with your current insurer or switch.

How home insurance renewal works

Most home insurance policies run for 12 months and generally auto-renew on the anniversary of the start date. The price you pay should stay the same throughout this period, unless any of your details change, for example, if you move home, make extensive home improvements (where you need to change the insured amount) or add optional extras.

Your provider will typically contact you around a month before your renewal date with a renewal notice, which will include your cover details and the price of next year's policy – but not all are that efficient so always set yourself a reminder.

You can then either auto-renew (which is rarely cheapest), haggle for a better deal, or switch to a new provider.

Insurers can't charge existing customers more than newbies, but most can still save by switching

Since 2022, insurers have been banned from charging existing customers more at renewal than those taking out a new policy with the same firm – a process known as 'price-walking' or the 'loyalty premium'.

But don’t assume your renewal quote is competitive. Different insurers price risk differently, so you should always compare quotes before renewal to see how much you could save by switching. Simply letting a policy auto-renew is rarely the cheapest option.

When is the best time to renew home insurance?

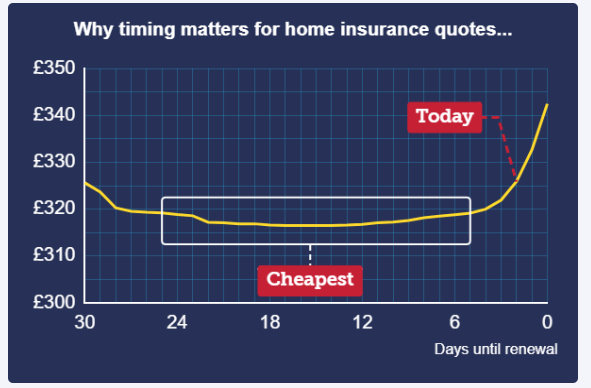

The cheapest time to buy home insurance is typically around 5-25 days before your policy ends (15 days before is the sweet spot). On average, buying in this window results in lower prices than renewing on the day your policy expires.

This is based on our analysis of around 650,000 home insurance quotes using data from MoneySupermarket, which shows prices generally rise the closer you get to your renewal date. A similar pattern is seen with car insurance, where the price differences tend to be even bigger.

We found the average cost of a home insurance policy on renewal day was £341 a year, compared with £316 when bought around 15 days earlier – a difference of £25.

Why is it cheaper to buy home insurance earlier?

In general, the closer to your renewal date you get quotes, the more of a risk you’re deemed to be, as leaving insurance to the last minute is often associated with a higher likelihood of claims.

However, getting quotes too early, for example, 28 days or more before renewal, can also push prices up, as fewer insurers offer quotes that far in advance.

The biggest savings usually come from switching insurer, not timing alone – but checking prices around two to three weeks before renewal gives you the best chance of a cheaper deal.

How to find the cheapest home insurance quote

It's unlikely that your renewal price is the best deal you'll find, so always compare policies during the pre-renewal period to see how much you could save from switching.

This even applies if you're set on sticking with your current policy, as it gives you a benchmark you can use to haggle with your existing insurer.

We explore the steps to buying home insurance in more detail in our dedicated Cheap home insurance guide, but for a quick quote and cost-cutting tips, use our tool...

Use our Compare+ Home Insurance tool to find cheap quotes

Our Compare+ Home Insurance tool incorporates all of our tricks and tips. It gives you a benchmark quote from comparison site MoneySupermarket, then gives you bespoke tips based on your answers to the question set to help you try and beat your top quote. Give it a try now...

Not at renewal? Still check now – you could save big by switching early

Many people assume you can’t change home insurer mid-policy, but you usually can – and if prices have fallen since you took your policy out, it can be worth checking.

Use Compare+ to see what you’d pay if you switched now, setting a policy start date around 15 days ahead (the sweet spot for lower premiums). If the new quote is significantly cheaper than what you're paying, it's worth considering – as long as you've not made, or plan to make, a claim for this insurance year.

If you can save big, sign up for your new policy, then cancel your old one. You should get a pro-rata refund for the rest of the year (minus a £50ish admin fee - check the amount before doing this). You’ll usually also lose any no-claims discount built up during the current year.

How to cancel your home insurance

Whether you're close to renewal or not, if you want to cancel a home insurance policy, you'll need to contact your insurer before the automatic renewal date, typically by phone or online chat. See our How to cancel your home insurance guide for a step-by-step breakdown.

Want to learn more about home insurance? We've plenty of guides on the topic:

Home insurance renewal FAQs

No, you usually aren’t charged any fees for renewing your policy, though we are aware of some insurers charging a renewal fee for some insurances. Depending how you have paid, your insurer may take the full cost or an initial instalment before it renews. However, you should get this refunded if you decide to switch. If the switch happens after the renewal date, you could be charged for the time you have been covered and a possible administration or cancellation fee.

And remember, insurers can't charge existing customers higher premiums than new ones due to Financial Conduct Authority (FCA) rules.

Yes, insurers can decide NOT to auto-renew your policy, typically because of either:

-

Increased risk. For instance, if you made a high number of claims last year or you're planning major home renovations.

-

Breaching the policy. For example, by missing payments or failing to disclose important information, such as leaving your home unoccupied for an extended period.

However, if you believed you've been treated unfairly, it may be worth contacting the Financial Ombudsman Service to get things put right. See our Financial Ombudsman guide for more info.

Check your policy documents to see your renewal date, otherwise contact your insurer. Your provider should also send you a renewal notice around a month before the policy expires. But not all insurers are that efficient, so always set yourself a reminder.